When looking at the long-term aggregate impact on GDP forecasts, climate change effects look pretty small. But that shouldn’t be taken as a sign that they don’t matter.

This is especially true for economies that suffer a temperature shock. They lose growth prospects even eight years later due to lower investment and productivity losses.

Reduced Agricultural Productivity

For centuries, the core challenge of economic development was to overcome deprivation—a lack of resources that prevented households, communities, and governments from meeting their basic needs or enabling them to thrive. Today, the world has shifted to an era of insecurity, with households, communities, and economies at risk from natural disasters and other threats that can disrupt or destroy their assets.

A recent study by UMD and Cornell University researchers quantifies the man-made impacts of climate change on agricultural productivity growth for the first time, based on sophisticated computer simulations of crops being grown day-by-day. These models take into account the weather, which isn’t typically included in calculations of total factor productivity (a calculation that measures overall output per worker). This research demonstrates that when climate changes reduce agricultural production, it also depresses output in other sectors—notably, manufacturing and services—that are important to rural and broader national economies. Moreover, the impact on output in these sectors doesn’t fade over time. In fact, a 1°C increase in temperature depresses manufacturing output for around seven years after the shock.

Increased Infrastructure Damage and Costs

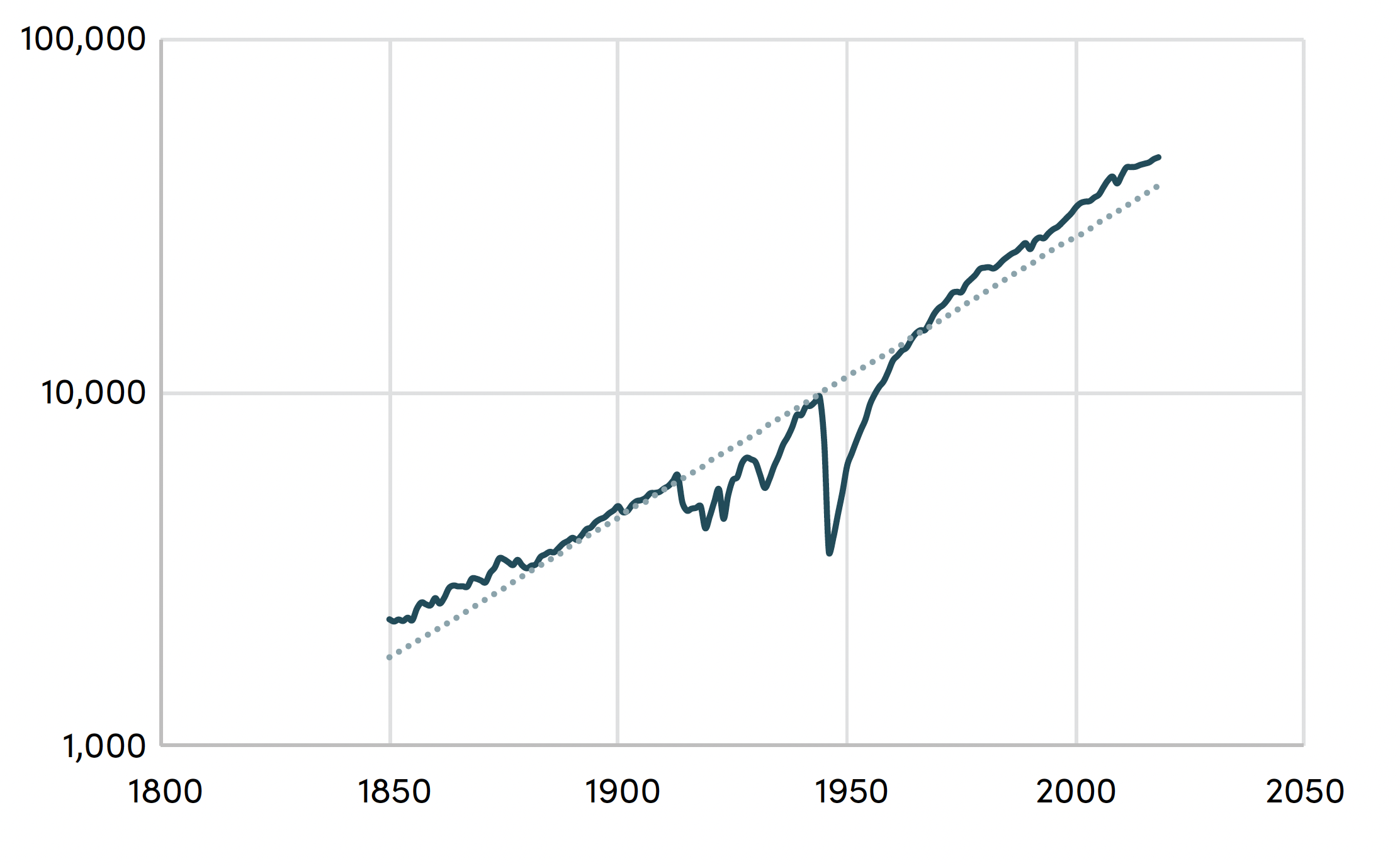

The economic damage from climate change can also be substantial for lower- and middle-income countries. In fact, even with rapid recovery of growth following a one-time temperature shock, these economies remain below their prior peak two years later and have an overall GDP gap with economies in cooler climates of eight years or more (see chart 3).

While the impact on economic activity can be quite large for poor countries, long-term global GDP trends often look small, so those who use them to downplay the urgency of action on climate change are likely to be missing a significant portion of a major problem. However, misdiagnosing the climate crisis by looking at aggregate global trends is just as dangerous.

The analyses of rail, roads, and coastal properties in this paper estimate costs of climate risk under three infrastructure management response scenarios (No Adaptation, Reactive Adaptation, and Proactive Adaptation). These estimates show that the low $10s of billions annually that might be required for implementing effective adaptation measures is a very small price to pay to reduce the economic risks from climate change.

Disruption of Supply Chains

The global economy is interlinked by supply chains that run across oceans, land, and air. This network is particularly vulnerable to disruption by climate change. For example, a shipping company might stockpile cargo to avoid losses due to a lack of space on ships or delays at ports. This could lead to higher prices for consumers.

UC Davis researchers have found that economies are sensitive to persistent temperature changes over at least a 10-year period. In fact, a one-degree Celsius increase in temperature reduces GDP by about 1.1 percentage points. They also find that the impact is much more severe in poor countries than in richer ones.

This is likely because the costs of adaptation are more concentrated in those nations who carry relatively little responsibility for creating the climate problem. These countries need to prioritize economic growth alongside effective disaster-response mechanisms and concessional finance. This will require reforming the international financial architecture to ensure greater funding for development focused on these nations along with large-scale, affordable, and rapid emergency financing mechanisms.

Rising Insurance Costs and Financial Losses

As the effects of climate change continue to accumulate, they could also impact household financial stability. Households in impacted areas may face higher expenses due to loss of income and interruptions or closures across a range of services. Additionally, households could lose access to credit and insurance.

In addition, climate hazards can lead to delinquencies and forbearances, resulting in increased interest rates for household borrowing. These financial costs can add up for households with limited savings, as they struggle to manage the impacts of climate hazards on their income and expenses.

Countries’ economic resilience to climate change is a critical factor in determining how much of a hit they take from weather shocks. A University of Notre Dame study shows that economies with greater readiness to cope with climate change tend to recover faster from the negative impact of a one-off temperature increase. This is largely due to supportive macro policy responses, with restrictive monetary policies amplifying the impact of climate change on GDP and flexible financial instruments cushioning it.

Healthcare Costs and Productivity Losses

On a country-by-country basis, the study finds that a one degree Celsius temperature rise reduces GDP per capita by about 1.1 percentage points in poor countries. On a sector-by-sector basis, agriculture is hit hardest (with output being around 1 point lower seven years after the shock), and manufacturing and services are also depressed.

Those economies in hotter climates are hit harder still and, even after a year of recovery, output is still about 1.5 points lower than it would be in the absence of the one-time increase in temperature. The study’s results show that the impacts of weather-related climate change may not be fully visible in aggregate indicators such as global GDP, since they have a long-term impact on growth.

This study and others like it highlight how climate change is a bigger problem than is usually recognized. And it exposes that “lukewarmers” who use long-term global GDP trends to downplay the danger are wrong, and that “doomsayers” who see the world heading toward a hotter version of the stone age are equally wrong.

Impact on Tourism and Hospitality

The tourism and hospitality industries are vital components of the world economy. They bring in foreign exchange, create employment opportunities, and provide a source of entertainment.

Tourism also has a strong impact on the environment. In fact, it is one of the fastest growing and most significant contributors to global ecological changes. In many places, the emergence of tourism has led to the preservation of delicate ecosystems.

In addition, tourism often has a ripple effect in local economies. For example, hotels and restaurants may serve as a catalyst for the development of other businesses, such as commercial laundry services or pet boarding facilities. This can increase the overall economic growth of a region.

However, there is a tradeoff between the positive effects of tourism and the negative environmental impacts. For instance, air travel is a major cause of climate change. A recent study by UC Davis scientists found that economies are sensitive to persistent temperature shocks, and GDP responds nonlinearly to temperatures. This indicates that countries in warmer regions face a more permanent loss of productivity than those in cooler regions.

Shifts in Investment Patterns

The impacts of climate change are complex. They include not only market-based damages reflected in higher costs of GDP but also non-market losses, such as those on human health and the ecosystems, that are difficult to measure in dollars and cents.

It is therefore important to understand that economic analysis of climate change needs to go beyond monetary measures to cover the range of non-market effects. For example, a transition to clean energy requires the removal of fossil fuel subsidies. This will result in lower energy prices and may reduce investment in renewable energy technology as firms perceive these investments as too risky.

This is particularly true in low-income countries that are more vulnerable to climate impacts. The cost of renewable energy and battery technologies — both critical for clean, affordable, and resilient electricity — has fallen dramatically over the past decade. This shift is reshaping the investment landscape. As a result, portfolio construction strategies must be designed to incorporate these trends into the mix. Moreover, investors need to ensure that their allocations are well-diversified across geographies and sectors.

Conclusion

The impact of climate change on GDP growth rates varies greatly by country. A one-time temperature increase reduces a poor economy’s growth by about 1.1% (see chart 5). It does so mainly through lower investment and productivity losses, but also through higher infant mortality. These effects are particularly large for economies concentrated in the tropics, and they persist for eight years after a temperature shock.

In the long run, overall global economic losses due to climate change are small, and they may even turn out to be smaller than many forecasters expect. But that does not mean the issue is insignificant. “Lukewarmers” who use global GDP trends to downplay the urgency of climate change are missing a large part of the story. And “doomsayers” who think the world is headed toward a hotter stone age are equally off base.

Countries that are better prepared to cope with the physical risks of climate change fare much better. Countries that are highly flexible in product and labor markets, have elaborate social safety nets, and stable institutional setups see little scarring from a one-off increase in temperature, and they recover relatively quickly.